Basic logic of trade operations

The MultiTrendTrader Expert Advisor operates according to the the color of the trend signals.

Green

Upward trend

Opening of a buy position (Long)

Red

Downward trend

Opening of a sell position (Short)

Yellow

No clear trend

No position is opened.

When being activated the first time, the expert advisor opens one ore more positions in the direction of the activated time frame. In case of positions already running, an opposite trend signal will lead to the closing of these positions and opening of one ore more new positions in the direction of the new trend.

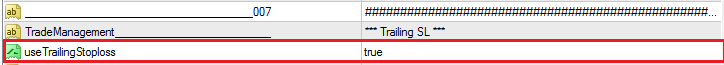

In case a trend signal changes to "yellow", the trailing stop loss - when being activated - will move to the entry price level, if possible. If the position is still "in the red", the trailing stop will only move to the entry price level once the position runs into profit.

It was a knowingly decision by myself to do without the possibility of a fixed stop loss or take profit because I thought this would contradict to the general trading idea behind the expert advisor. The intention is to profit from a prevailing trend as long as possible and avoid being stopped out too early be the means of a fixed stop loss or take profit level.

Test my EA free of charge

Assure yourself of the MultiTrendTrader EA for one month without obligation!

How to use the expert advisor

Designed as a trend following system, the trading approach is pretty much predetermined. Nevertheless, the software still offers multiple possibilities to adjust the settings according to your requirements.

However, the basic benefit of the expert advisor is that it enables you to trade any instrument simultaneously at multiple time frames. In doing so, the trend signals of each activated time frame operate independently from each other. For example, if the trend signal for the 15 min time frame is "red" and thus leads to the opening of a sell position, the signal of the H1 or the H4 time frame at the same time can indicate "green" and thus lead to the opening of a buy position (see the indicator on the start page).

Whether or not you want to trade one or several currency pairs at the same time on one or multiple time frames with different lot sizes and stop loss levels - in the end it is just a question of your trading strategy, your personality as a trader and most of all of your financial possibilities. The software allows easy configuration of input parameter according to your requirements.

Special features

In order to increase the profitability, I paid special attention to the implementation of the following special features which require a more detailed explanation.

-

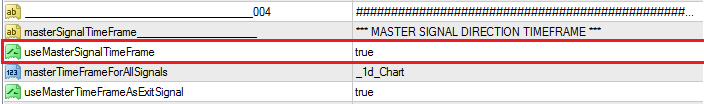

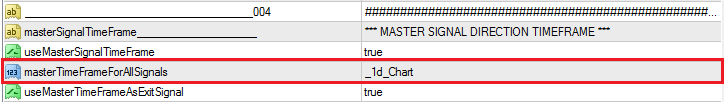

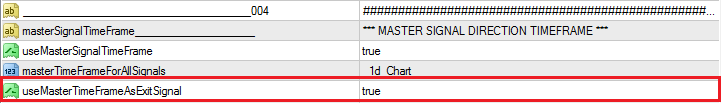

Master Time Frame

You can define any time frame as a so-called Master Time frame. The sense of doing so is to define trend movements of higher times frames as "trend-setting" so that trades in lower time frames can only be opened in the direction of the master time frame. The accordance of the trend direction of the master time frame and the time frame where the trade actually takes place will increase the chances of profit. The reason for this can be atttributed to the (usually) long lasting trend movements of the master time frame, ranging from days to weeks. Trades that in the beginning tend to move against the trend of the master time frame usually sooner or later follow the trend direction of the master time frame.

-

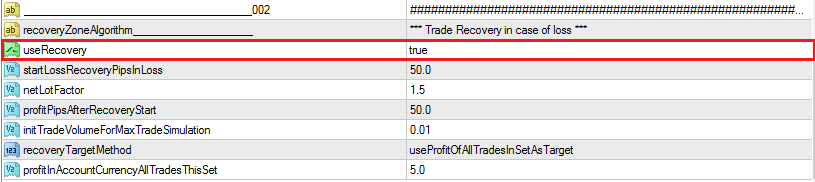

Loss Recovery Function

The loss recovery function basically is a hedging martingale system that is able to turn potential loosing trades into winners. The function is triggered once a trade goes into the "wrong" direction and reaches the max. allowed DD defined in the Parameter startLossRecoveryPipsInLoss.

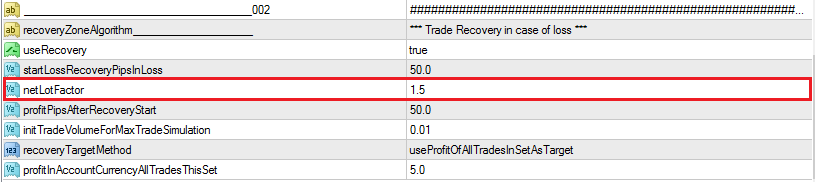

In this case a trade into the opposite position of the initial trade is opened with an increased lot size according to the setting of the parameter netLotFactor (multiplier)..

Both positions remain open untilt the targeted profit is reached. In case the 1st recovery trades also reaches the max. allowed DD, a 2nd recovery trade is opened, now again into the trend direction of the initial trade.

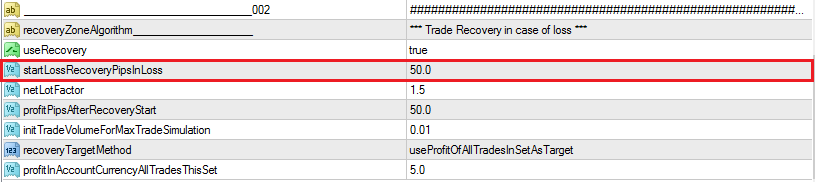

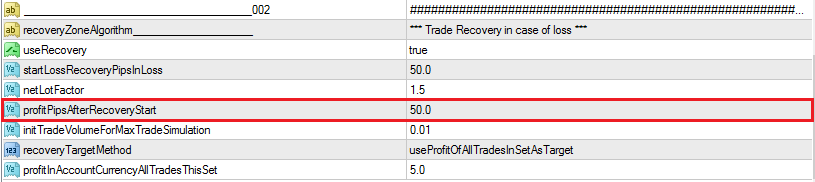

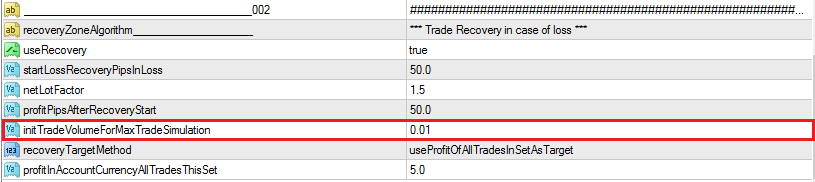

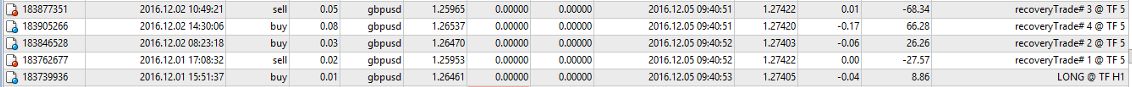

The following example depicts in detail how the recovery mechanism works. The parameter settings were as follows:- startLossRecoveryPipsInLoss: 50 pip

- netLotFactor: 1,5

- targeted profit: € 5 -

Note: Usually the targeted profit (here: € 5) is not reached exactly but rather fluctuates around the targeted profit with approx. € 0,5 which has to be accepted as a normal trading behavior. This phenomenon also applies to the rate at which recovery trades are opened. Although the parameter startLossRecoveryPipsInLoss is set to 50 pips, it can be seen from the screenshot above that the difference between the singles trades is not exactly 50 pips (e.g. 50,8 pips between the initial trade and recovery trade #1).

In market phases without a clear trend direction the hedging mechnism can lead to the opening of many buy and sell positions eating up your marging. Therefore, you should pay attention to a sufficiently funded trading account right from the beginning. Taking into account my favorite settings (see "functions/ input parameter"), I recommend a trading account being funded with € 500 minimum for each single currency pair traded to be bullet-proof. In case you want start with less (which is also possible) I recommend trading gold.In order to enable you to estimate the risk of your settings, relevant information is displayed right underneath the indicator on your chart (see section "Information on the chart" further below).

Note: Of course you can start with less than € 500 on your account; as you can see from my life account I calculate € 250 for each currency pair I trade. However, if you face a situation where recovery trades are eating up your margin and you risk a margin call, you might consider the following provisions:

- Increase the leverage, e.g. from 1:200 to 1:400

- If possible, use the feature "inter-account transfer" and deposit additional money on your account to increase the margin level.

- If possible, use the service of a global online payment solution as e.g. Neteller or Skrill as with these services funding of your account will be usually processed within a timeframe < 60 min.

Any questions about the MultiTrendTrader EA?

I'll gladly help you any time!

Features / Input parameter

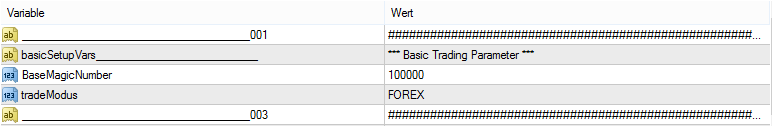

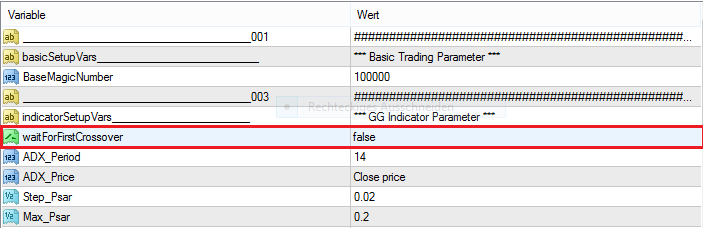

The following list contains a detailed explanation of the most important input parameter. The values indicated are the same I use with the EA on my own account.

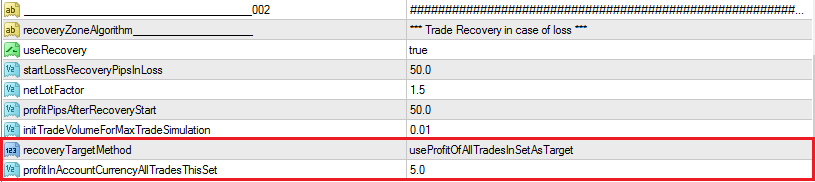

Basically, there're two possiblities to determine the exit of a set of trades (initial trades and all corresponding recovery trades):

usePipsForLastTradeAsTarget: The entire set of trades is closed once the last trade within the recovery trades is in profit according to the settings made in the parameter „profitPipsAfterRecoveryStart“.

useProfitOfAllTradesInSetAsTarget: Here you determine an amount (in account currency) that triggers closing of all trades once the sum of all trades reaches the determined amount.

The settings for the LossRecovery function are valid for all activated time frames. Information about how you can configure the settings for each activated time frame individually can be found in the Q&A section.

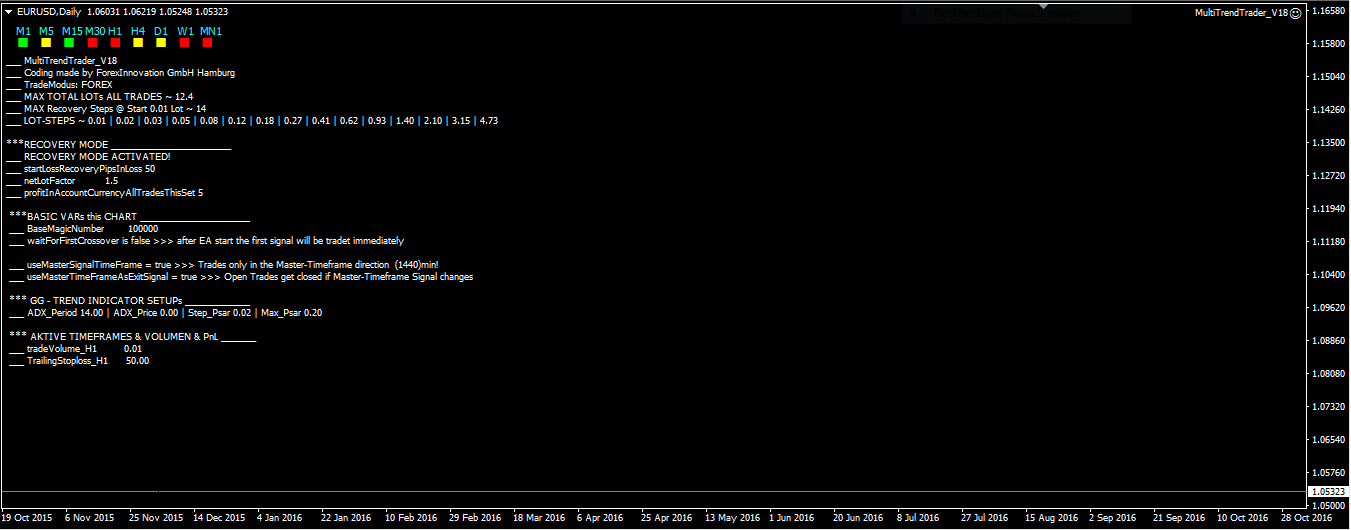

Information displayed

Once the expert advisor is activated, important information about the risk profile of your settings is displayed on the screen. As you can see on the example screenshot - this information is listed immediately underneath the GG-Trendbar indicatior.

Below the GG-Trendbar indicator you will find some specifications that require a more detailed explanation for they don't appear within the parameter settings of the MultiTrendTrader Expert Advisor.

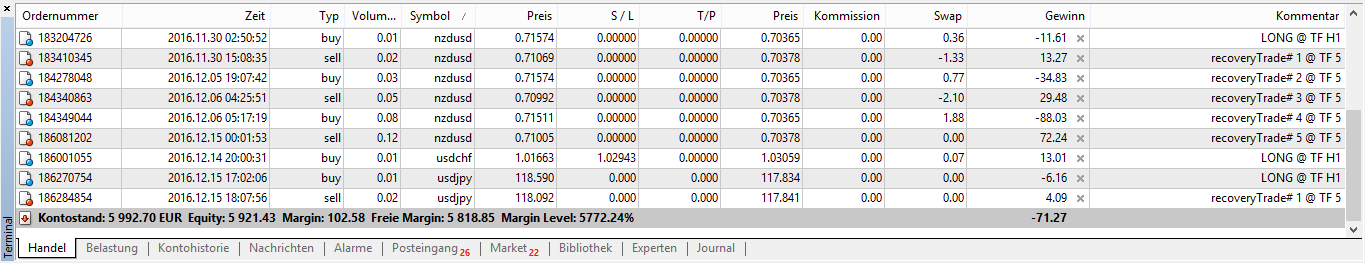

Terminal

When you enable the Comment function you will see a note behind each trade as depicted in the following screenshot.

Tip: Use the weekend when the market is closed to "play around" with your settings. Since the impact of your changes are immediately visible as information on your chart this is quite a good possibility to find out which setting fit your requirements best.

Generally I recommend to set your parameter in such a way that a minimum of 10 recovery steps are displayed.